Slacking customers are inevitable when it comes to business. It is extremely irritatin to see outstanding invoices when you know that they had to be paid months ago. It is vital for the business to maintain a healthy and steady cash flow in order to continue development and growth. However, the idea of this post is to teach you how to handle this on a professional level without panic and retrieve all of your outstanding invoices up to date.

Side Effects of the Late Payments

Just before you start your business everyone else would probably think that late payments might not be an issue. This might not be an issue for really small business just starting and trying to establish customer relation for other SME. However, late payments might turn into nightmare when it comes to larger businesses.

Cash Flow I do not think there is a way for me to stress the importance and the need of the consistency for your cash flow in the business. Inconsistent cash flow might have a damage in a long term over your own payments and lead to other financial problems. Perhaps in the worst case scenarios this might even mean that your business might close its doors for business due to slacking customer payments.

Book Keeping is another crucial affected part due to the slacking customer payments. For example, a customer has not paid their invoice due to X, Y reasons and that might make you sweat and get slightly nervous. The submitted invoices are calculated and once the expenses are excluded this is counted as revenue. However, if an invoice is missing this reports will be inaccurate. If you are the sole owner of the company, that might now be an issue but if there is board of directors and investors, you might have to answer some questions.

Your Reputation is on the line when it comes to collecting the invoices and making sure everything is accurate. I think that the best way to deal with this is to be very strict with the invoices. If you build a reputation that you are accepting late payments that will damage your business and might affect the rest of your clients. There is a huge danger that they might become slacking customers too.

Strategies to stop the Slacking Customers

Luckily there are plenty of strategies to implement in order to protect your business from the late invoice vouchers.

Build Invoicing Process

Build up your invoicing process so your business can last long. The reality is that if you do not have invoicing process in place this will not be happy ending. In the worst case scenario, you do have an invoice process in place but you do not strictly follow it. Depending of the size of the business an invoicing software might be an ultimate solution to your problems. However, not all businesses can afford invoicing software when they are small SME.

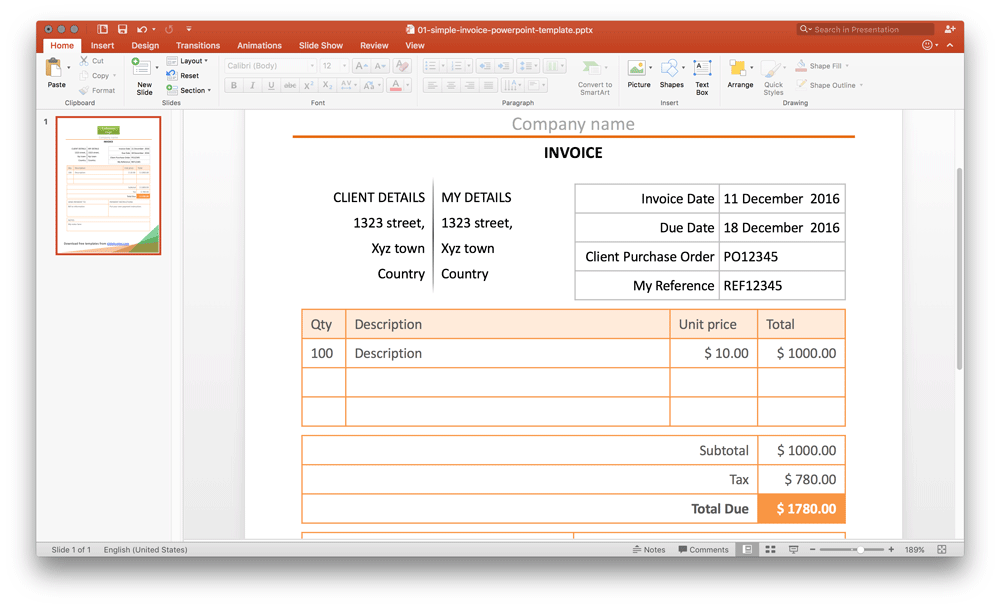

If you are using a paper-based invoicing process you can use some invoicing templates, just make sure that everything makes sense on paper. All of the written protocols must be followed strictly by you and your employees. I suggest having a process in place on how to check if your employees keep the invoicing process nice and tidy.

Formal Warnings

There will always be a slacking customer that will not issue their invoices on time and eventually that might be crucial for your business. However, it the problem appears within your business, it might be a good idea to send formal emails giving them friendly reminders as a first step. You might want to try again within the next 2-3 business days. If they tend to ignore the emails for some reason, you might have to pick up the phone and require to speak with the person responsible for the invoicing directly. However, if this strategy does not work either, gently remind them that legal precautions will be taken against their negligence.

Extended Plans and Payment Methods

Once you figure it out which clients are very slow with their payments. I think it might be a good idea to treat the two groups differently. Most of the time the late invoices might be due to the fact that your customers forgot, or they were too busy with work.The reason also might be due to the fact they struggle for cash flow. The best part is that you can use invoicing software to help you split out the outstanding invoices into smaller pieces depending on the circumstances of course.

It is very important to keep track of all your business activities documented and in order. If you run into trouble with slacking customers, use the alternative strategies listed above and be brave to act.