In today’s fast-paced and unpredictable financial landscape, it’s essential to plan for the future and ensure financial stability. Creating a passive income stream is a smart way to build long-term wealth, as it allows you to generate revenue without actively participating in the process. However, to maximize the benefits of passive income, it’s crucial to diversify your investment portfolio. Diversification helps minimize risk and increase the chances of achieving a steady flow of revenue.

Diversification: The Key to a Robust Passive Income Stream

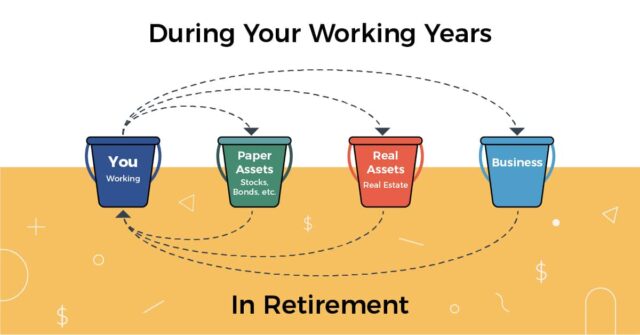

Diversification is a fundamental investment principle that involves spreading your investments across various asset classes, sectors, and geographical regions. This approach helps reduce risk and improve the overall performance of your investment portfolio. Diversifying your passive income stream is crucial for several reasons:

Risk Management

By diversifying your investments, you can minimize the impact of individual asset failures on your overall portfolio. For example, if you were only invested in real estate, an economic downturn or housing market crash could significantly affect your earnings. By spreading your investments across different sectors and asset classes, you can mitigate the risks associated with market fluctuations and ensure a more stable money stream.

Capitalizing on Market Opportunities

Diversification allows you to take advantage of various market opportunities, as different asset classes and sectors often perform differently in different market conditions. By holding a diverse range of investments, you can benefit from the growth of multiple markets and industries, increasing the potential for higher overall returns.

Ensuring Consistent Income

By relying on a single source of passive earnings, you’re at risk of losing your entire stream if that source fails. Diversifying your earning sources ensures that you’ll continue to receive money even if one or more of your investments underperform.

Hedge Against Inflation

Inflation can erode the value of your investments over time. Diversification helps protect your stream from the effects of inflation by including investments with inflation-hedging properties, such as real estate or commodities.

Strategies for Diversifying Your Passive Income Stream

Now that we understand the importance of diversification, let’s discuss some strategies to help you build a diversified passive income portfolio:

Invest in Dividend Stocks

Dividend stocks are shares of companies that pay out a portion of their earnings to shareholders in the form of dividends. These stocks can provide a steady source of passive earnings while also offering the potential for capital appreciation. To diversify your dividend stock portfolio, consider investing in companies from various sectors and industries.

Explore Real Estate Investment Options

Real estate can be a lucrative source of passive income, with options ranging from rental properties to real estate investment trusts (REITs). Rental properties can provide steady monthly cash flow, while REITs offer exposure to the real estate market without the need to manage physical properties directly.

Tap into Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with investors, allowing you to earn interest on loans made to individuals or businesses. By investing in multiple loans with varying risk profiles and durations, you can diversify your P2P lending portfolio and reduce risk.

Consider Investing in Bonds

Bonds are fixed-income securities issued by governments or corporations, which pay periodic interest payments to bondholders. Bonds can provide a relatively stable and predictable source of passive income. To diversify your bond portfolio, consider investing in a mix of government and corporate bonds, as well as bonds with different maturities and credit ratings.

Generate Royalties from Creative Works

If you possess creative talents, such as writing, music production, or graphic design, you can generate passive income by licensing your work to others. This can include royalties from book sales, music streaming, or licensing fees from the use of your images or designs. By creating a diverse range of creative works, you can increase the likelihood of steady passive income.

Conclusion

In conclusion, diversification is key when creating a passive income stream. It ensures that you are able to spread your risk across multiple sources and also gives you the opportunity to test out different strategies in order to maximize your potential earnings. Taking this approach can help reduce uncertainty and increase the chances of long-term success. With some hard work and dedication, anyone can create a successful passive stream by diversifying their sources of revenue.